explain how operating and finance lease are treated and why

The lease arrangement calls for a flat monthly fee up to 19500 machine-hours. The company is proposing to finance the purchase of either machine with a term loan at a fixed interest rate of 11 per year.

-A-Guide-for-Tech-Com/Tech_Lease-Accounting-Guide_brochure_10-18_webcharts1.png.aspx)

Lease Accounting A Guide For Tech Companies Bdo Insights

This would provide a better system because materials could be stacked higher and moved more quickly.

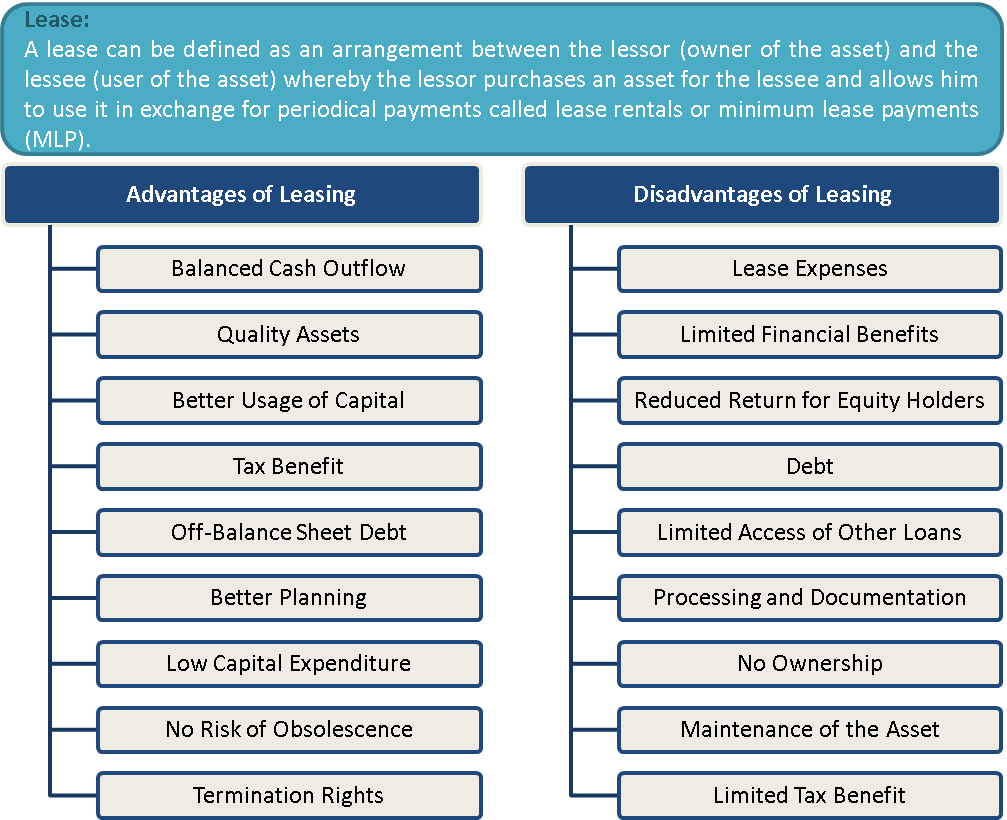

. Lease expense is a major element of overhead cost. Although lease expenses get the same treatment as interest expenses the lease itself is treated differently from debt. You dont need to upload an Operating Agreement on the states website.

A TRAC lease guarantees your business a pre-set buy out price for the vehicle when the lease expires. This is why companies dont admit to wrong doing for dumping waste. The Operating Agreement is an internal document that you just keep with your business records.

Conveniently located in Concord New Hampshire we are a quick drive from ManchesterSince 1957 weve built an impeccable reputation by operating an honest business and treating every customer with the highest degree of professionalism and respect. This is basic human nature and true everywhere. Access the answers to hundreds of Cash flow statements questions that are explained in a way thats.

Hi Prince no they dont create an account for you with the New Mexico Secretary of State. During the preparatory works ABC discovered that the operating lease contract related to a machine might require some adjustments. If the machine-hours used exceeds 19500 then the fee becomes strictly variable with respect to the total number of machine-hours consumed during the month.

They are especially useful for financial requirements of institutional investors such as pension funds and for investors such as retired individuals seeking yield. Operating losses resulting from the use of prior year departmental appropriations for Administered payments would normally be considered technical losses and can be approved by FinanceShould an entity consider that an operating loss is likely for any reason they should contact the relevant Finance AAU. You dont send it to the state.

The main attraction of income trusts in addition to certain tax preferences for some investors is their stated goal. Financial mathematics is easier to explain and understand through the use of examples and for this reason most sections include a number of updated solved problems. This is why the fia doesnt admit it fixed the f1 championship.

Drawing power is the limit up to which a firm or company can withdraw from the working capital limit sanctioned. Get help with your Cash flow statements homework. And this is why dirty cops dont go to prison.

Banks Autos is New Englands highest-volume General Motors dealer. The megadrought bedeviling the American West got even drier last year and is becoming the deepest dry spell in more than 1200 years The billionaire who flew on his own SpaceX flight last year is. You dont need one.

Health and safety risks for the workers would be reduced and there would be savings of 5000 each year in overtime payments. ABC the manufacturing company needs to adopt the new standard IFRS 16 Leases in the reporting period ending 31 December 2019. A to calculate for both the standard and the de-luxe.

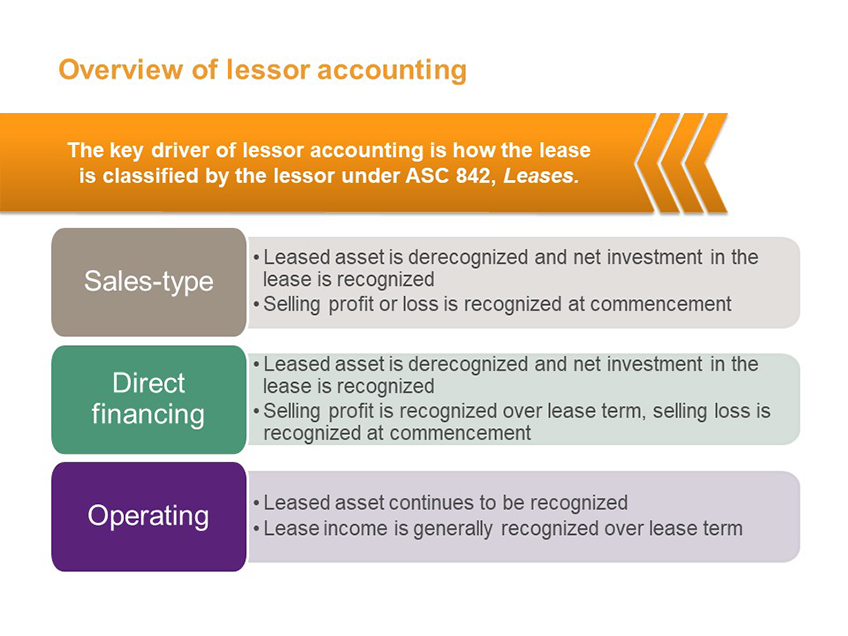

The company could lease two fork lift trucks at a cost of 20000 each year. All lease shall be classified as Finance lease unless it is a low value asset and the lease term is only for 12 months then we have to account the right of use asset under PAS 16 using either Cost model Fair value model or revaluation model. A family-owned and -operated dealership with.

Drawing Power generally addressed as DP is an important concept for Cash Credit CC facility availed from banks and financial institutions. This type of equipment lease is a great tool for business owners who want the option of buying the vehicle for a pre-determined price at the end of the lease and typically offers lower payments than a standard lease while providing certain tax. Updating drawing power for working capital by the bank is an important credit monitoring exercise.

The legal system will never hold these people accountable because it works against their interests to. Operating lease in the lessees accounts under IFRS 16. Taxation at 35 is payable on operating cash flows one year inarrears and capital allowances are available at 25 per year on areducing balance basis.

Since under IFRS 16 Operating lease was eliminated in Accounting for lessee. Leasing expenses or lease payments are considered as operating expenses and hence of interest are tax-deductible. Cash Flow Statements Questions and Answers.

An income trust is an investment that may hold equities debt instruments royalty interests or real properties.

Asc 842 Classification And Accounting Treatment Of Lease Revgurus

Lease Classification Cornell University Division Of Financial Affairs

Real Estate Development Financial Feasibility Development Real Estate Development Real Estate

What Is Leasing Advantages And Disadvantages Efinancemanagement

Lease Accounting An Overview Of Asc 842 Gaap Dynamics

Operating Leases Vs Finance Leases Key Differences You Need To Know

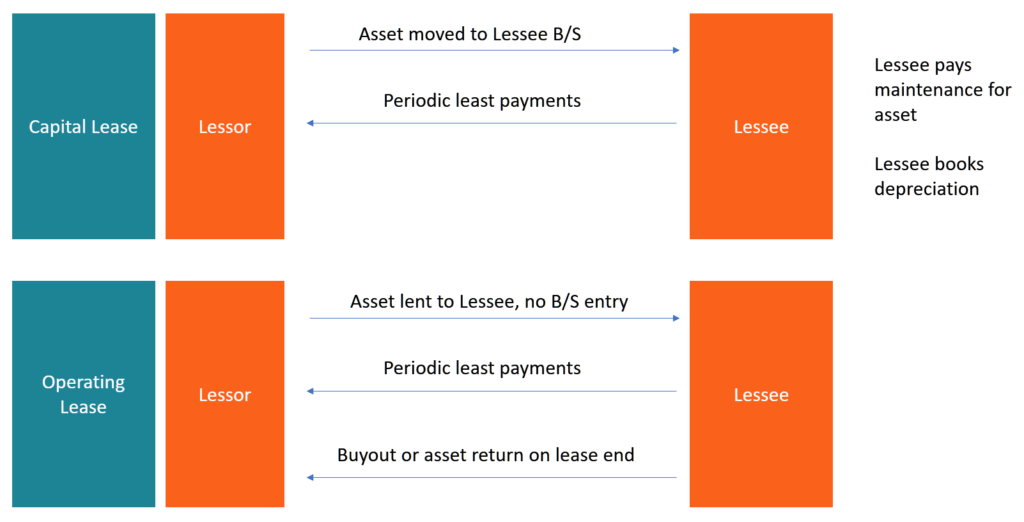

Capital Lease Vs Operating Lease What You Need To Know

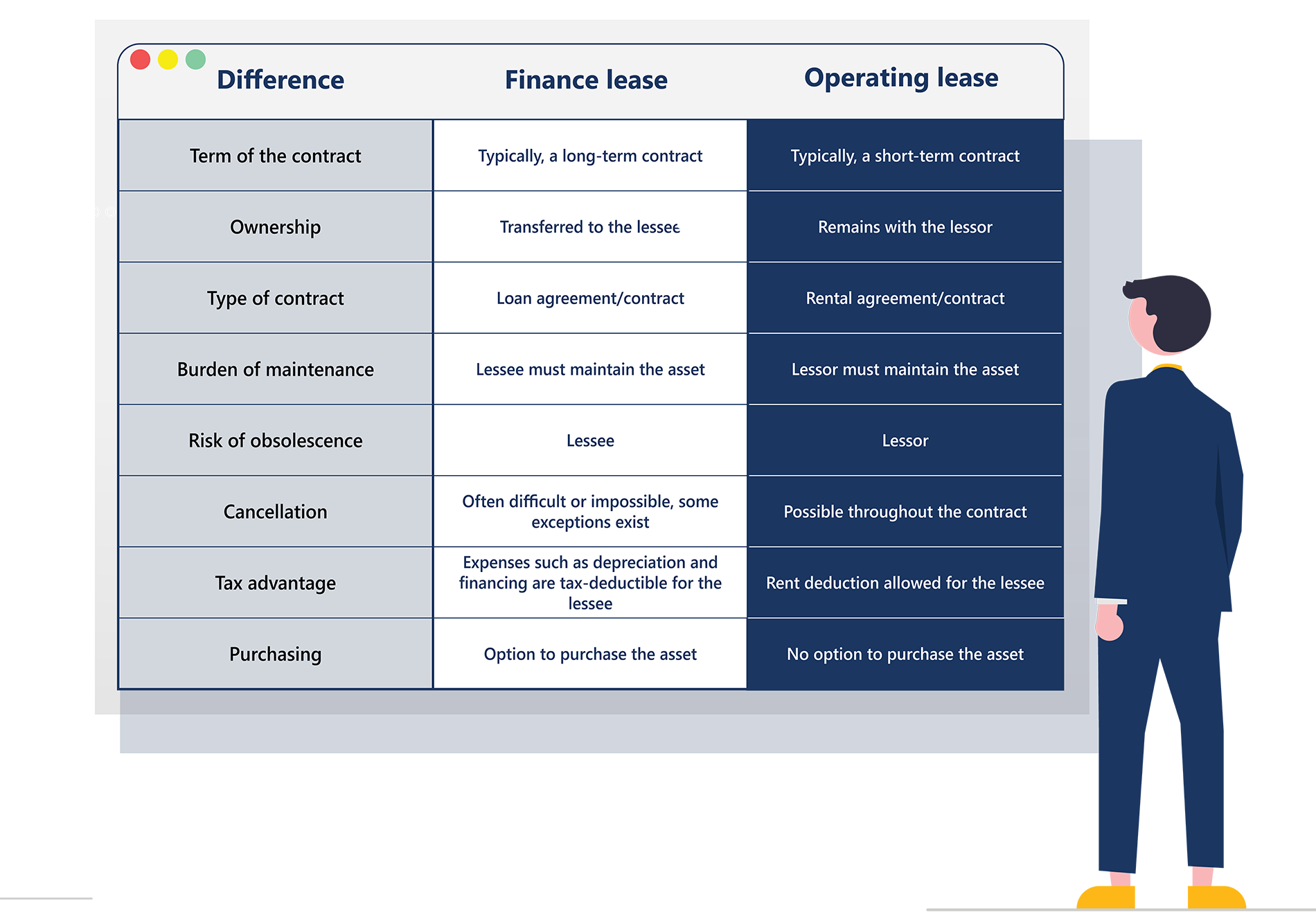

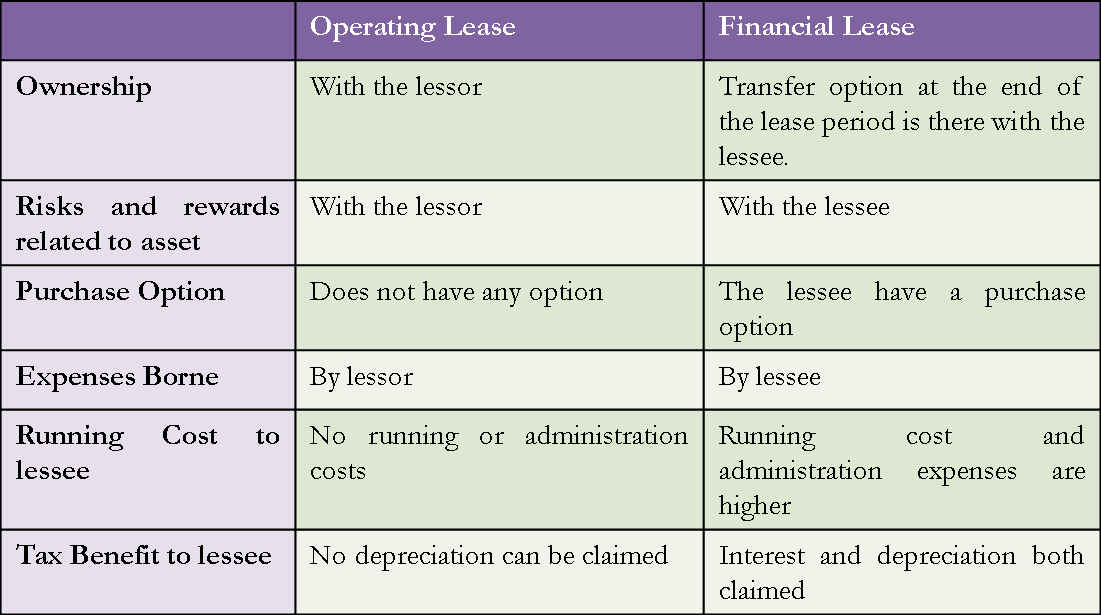

Difference Between Operating Versus Financial Capital Lease Efm

0 Response to "explain how operating and finance lease are treated and why"

Post a Comment